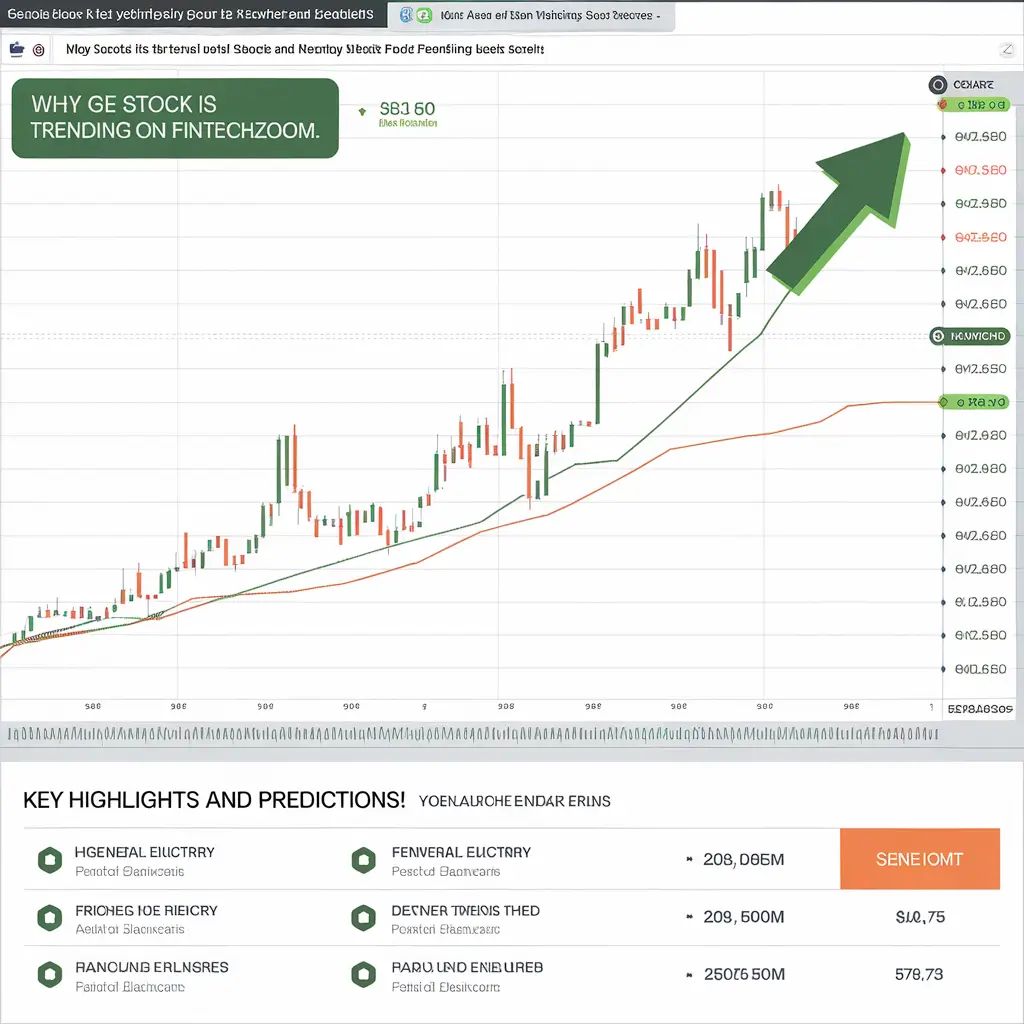

Why GE Stock Is Trending on FintechZoom: Key Highlights and Predictions!

Investing in stocks can be challenging, with both opportunities and risks. Recently, GE Stock has drawn significant attention, particularly on platforms like FintechZoom. But what’s behind this renewed interest in General Electric (GE) stock? Let’s dive into the key reasons for this surge, essential highlights, and future predictions.

Introduction to GE Stock and FintechZoom

General Electric (GE) is an American multinational conglomerate with a wide range of activities across the country and around the world and is active in such fields as aviation, energy, health care, and finance. As we discussed earlier the GE stock also had some of its up and down moments such as restructuring of its stock, as well as financial struggles. Nevertheless, new changes have led to innovation and popularity in the investment market, and thus it has become popular in FintechZoom.

Why GE Stock Is Trending on FintechZoom

Several recent factors have driven attention to GE stock:

- Strategic Restructuring: GE’s past strategic moves of separating the healthcare and energy divisions and then narrowing the company’s strategic focus have been made to better align the firm’s operations and improve shareholders’ value.

- Strong Earnings Reports: High earnings especially in aviation and renewable energy have surged market expectations for the operations of GE hence inviting investors.

- Leadership Changes: More so, the market has approved the maneuvers under its current CEO Larry Culp who has been overseeing activities such as debt reduction and operational excellence.

Key Factors Influencing GE Stock on FintechZoom

Several key factors have contributed to the performance of GE stock:

- Debt Reduction: This aspect of reducing the debt has enhanced GE’s financial position hence making it attractive for the investors.

- Sector Strength: The strategic concentration of GE on the top-growth industries such as aviation and renewable energy has strengthened the firm’s market status.

- Favorable Market Conditions: The improvement of the economic situation and the rise of infrastructure spending is good for industrial stocks such as General Electric.

Also Read: 5StarsStocks.com: Handpicked Stocks for 2024 – Invest Smart, Grow Fast!

Performance Analysis of GE Stock on FintechZoom

GE stock has shown positive trends recently:

- Stock Price Growth: Trends of constant raises involve earnings and strategic realignments Concerning an increase in the firm’s stock price.

- Financial Health: Bettering of revenues, profits, and cash proves that GE is in a better financial position hence attracting investors into it.

Expert Opinions on GE Stock: Insights from FintechZoom

Analysts offer varied perspectives on GE stock:

- Positive Outlook: According to many, GE has laid the base for its future with restructuring and growth focus and hence the stock is still undervalued.

- Cautious Views: However, some concerns are pointing out that GE is still when it comes to the process of getting out of the crisis, and economic instability remains a big concern. Nonetheless, a vast majority of analysts recommend that one should ‘buy’ it.

Strategic Moves and Business Developments Impacting GE Stock

GE’s strategic decisions have been crucial for its recent performance:

- Spinning Off Divisions: According to analysts, GE seeks to improve its focal areas and returns on equity by disposing of those segments that make less sense to it.

- New Partnerships and Ventures: Such important acquisitions in the aviation sector and GNRE increase the company’s positions and prospects for development.

Market and Economic Factors Impacting GE Stock

External factors also play a significant role in GE’s stock performance:

- Supportive Economic Trends: Post-pandemic recovery and infrastructure spending boost demand for industrial products.

- Potential Risks: Challenges like rising interest rates, inflation, and geopolitical tensions could impact GE’s growth trajectory.

Investor Sentiment and Speculation on GE Stock

Investor sentiment has been a driving force behind GE stock:

- Positive Sentiment: Improved performance and strategic clarity have driven optimism, increasing demand for GE stock.

- Speculative Interests: Some investors are looking for short-term gains, which adds volatility but reflects strong market interest.

Comparative Analysis: GE Stock vs. Industry Peers

Understanding GE’s market position involves comparing it with its competitors:

- Competitor Performance: The recovery of GE is riskier than that of competitors such as Honeywell and Siemens but it has the capacity for higher profitability that attracts the risk-taking investors.

- Benchmarking Against Indices: It serves to highlight that GE’s performance against other peers such as S&P 500 indexes demonstrates healthy interest from shareholders in its revitalization process.

Future Predictions for GE Stock on FintechZoom

Looking forward, several factors could influence GE stock:

- Short-Term Volatility: Continued restructuring might cause fluctuations, but the long-term outlook remains strong.

- Growth Catalysts: Success in aviation and renewable energy, alongside further debt reduction, are key drivers for future performance.

FAQS

1. Is GE stock a good buy right now?

GE stock is considered a good buy due to recent strategic changes, positive earnings, and growth potential. However, it is essential to consider personal risk tolerance.

2. Why is GE’s stock price high?

The increase in GE’s stock price is due to strong earnings, strategic restructuring, debt reduction, and growth in high-potential sectors.

3. What will be the GE stock price in the coming 2024?

Market anticipations indicate that the GE stock is expected to perform even better next year in 2024 if some key strategies are implemented and depending on market trends.

4. How profitable is GE?

Improve profitability has been witnessed at GE, especially through aviation as well as renewable energy where strategic focus and cost management have helped.

5. What companies are GE’s closest competitors?

The major competitors that threaten GE’s operations are Honeywell International, Siemens, and 3M which are in the same industries.

6. Bar chart- What was GE’s highest stock price ever?

However, the highest value in GE’s stock prices was in the year 2000 at $60 per share. Since then the stock has been volatile but there are indications of the improvement.

Conclusion: Should You Invest in GE Stock?

Is GE stock a good buy?

- Pros: Strong recent performance, strategic restructuring, and growth in key areas make GE an appealing option for those seeking high returns.

- Cons: Volatility and broader market risks remain concerns. Investors with a higher risk appetite may find GE a compelling choice.